n Finding reliable lenders can be facilitated by utilizing resources just like the 베픽 website, which offers complete critiques and comparisons of assorted lending options.

n Finding reliable lenders can be facilitated by utilizing resources just like the 베픽 website, which offers complete critiques and comparisons of assorted lending options. Look for lenders with transparent practices, competitive interest rates, and optimistic buyer feedback earlier than making a c

Understanding Repayment Options

Repaying a Day Laborer

Loan for Bankruptcy or Insolvency is an essential

please click the next webpage side to contemplate earlier than borrowing. Due to the short-term nature of most Day Laborer Loans, reimbursement timelines may be tight. Understanding what you'll owe and when is significant to avoid pointless charges or late fu

Choosing the Right Lender

Selecting an appropriate lender for a Day Laborer Loan is a major step for any employee. Not all lenders supply the identical phrases or ranges of customer support. It's advisable to conduct thorough analysis by evaluating totally different lending options based mostly on interest rates, compensation phrases, and buyer critiq

The major goal of same-day loans is to supply fast financial assist. This flexibility attracts numerous debtors, particularly in cases where immediate money circulate is critical. However, whereas same-day options provide fast entry to funds, they could also carry higher rates of interest compared to typical loans, making it important to explore all obtainable opti

Yes, same-day loans can have an result on your credit score score. Timely repayments can enhance your rating, while missed or late payments can negatively impact it. Some lenders report cost history to credit score bureaus, which implies your borrowing conduct can affect your general creditworthiness. Always try to handle repayments responsibly to keep up a healthy credit score sc

BePick is a complete platform devoted to providing valuable details about girls's loans. The website presents detailed evaluations, comparisons, and guides on numerous loan products available to ladies. By presenting in-depth analyses of

Unsecured Loan choices, BePick allows customers to make knowledgeable selections that align with their financial objecti

In addition to articles, BePick offers up-to-date news and tendencies related to lending practices, serving to shoppers keep informed about potential modifications in the financial landscape. Whether you're considering taking an extra mortgage or just looking for data, BePick is a useful useful resou

Understanding these limitations is important for both lenders and borrowers. It fosters an surroundings the place initiatives may be taken to deal with and mitigate these challenges, ensuring that ladies obtain the financial help they dese

It can be crucial for potential borrowers to know the terms of the mortgage they are considering. Interest charges, compensation schedules, and any hidden fees must be scrutinized in the course of the utility proc

Prioritize lenders who are licensed and regulated, as this means adherence to industry requirements and safety for debtors. Additionally, it's beneficial to choose lenders with excellent customer help, as this will considerably enhance your borrowing expert

Qualifying for a Day Laborer Loan typically entails a less cumbersome process compared to traditional loans. Lenders focus more on a borrower’s current situation quite than their credit historical past or employment standing. Most loans require fundamental data corresponding to identification, proof of income (even if irregular), and a bank statem

How to Apply for a 24-hour Loan

The software course of for a 24-hour mortgage is easy, catering principally to individuals looking for quick cash. Most lenders enable candidates to finish the whole process online. The preliminary step includes filling out an software type, which incorporates personal and monetary informat

Understanding Interest Rates and Terms

The rate of interest on a mortgage plays a crucial position in determining the entire cost of borrowing. Fixed-rate loans offer stability, while variable-rate loans might fluctuate over time, impacting monthly payments. Borrowers should assess their danger tolerance and monetary state of affairs before choosing between these opti

Why are Day Laborer Loans Important?

The financial panorama could be unforgiving, notably for these engaged in day labor. Traditional employment typically comes with predictable paychecks, but day laborers face durations of uncertainty. This is where Day Laborer Loans play a crucial role. They empower employees to handle unexpected expenses that would otherwise lead to extreme monetary mis

Moreover, the benefit of acquiring these loans can lead to monetary irresponsibility, where individuals might borrow more than they will afford. Proper budgeting and financial planning are crucial when contemplating these choices to keep away from long-term monetary str

An additional mortgage is taken to complement an present loan, usually under completely different terms, whereas a daily loan is obtained independently of different loans. Additional loans are normally required in circumstances where extra funds are necessary or when the unique mortgage doesn't cowl all expen

Moje viđenje trenutne situacije

על ידי Petar Miljic

Moje viđenje trenutne situacije

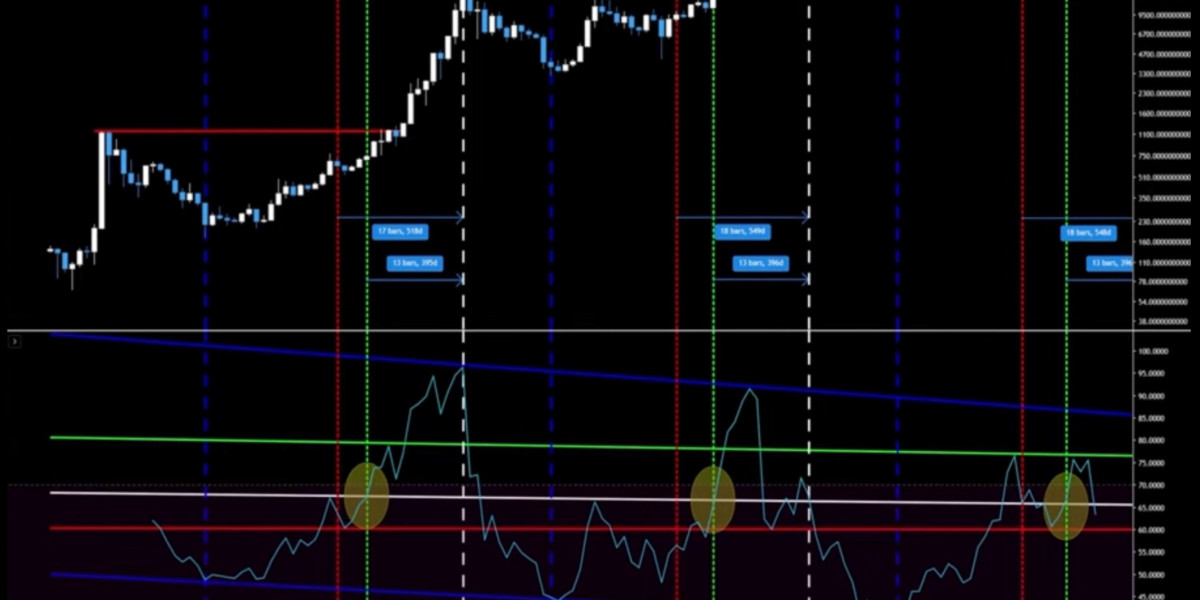

על ידי Petar Miljic Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic

Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp

Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic

Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic

Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic