Furthermore, 베픽 shares tips and best practices for utilizing mortgage calculators, guaranteeing customers can leverage their energy to its fullest potential.

Furthermore, 베픽 shares tips and best practices for utilizing mortgage calculators, guaranteeing customers can leverage their energy to its fullest potential. Whether you're a first-time homebuyer or an skilled borrower, 베픽 serves as an important useful resource in your financial jour

In addition to articles, BePick offers up-to-date news and trends related to lending practices, serving to consumers stay knowledgeable about potential changes in the financial landscape. Whether you would possibly be contemplating taking an additional mortgage or simply seeking info, BePick is a useful useful resou

Beppik: Your Resource for Personal Loans

Beppik is a dedicated platform designed to assist shoppers navigate the complexities of personal loans. The website presents detailed assets starting from how-to guides, tips about improving credit score scores, to thorough evaluations of varied lending instituti

It’s additionally important to look at the loan terms, together with the period of compensation, as longer phrases may have decrease monthly payments but improve the whole curiosity paid. Additionally, check for charges similar to origination charges,

이지론 prepayment penalties, or late cost charges that would add to the mortgage's total pr

Types of Loan Calculators

There are a number of kinds of loan calculators, each designed to cater to particular borrowing eventualities. Among the commonest are mortgage calculators, which help potential householders estimate their month-to-month funds based on residence value, down payment, rate of interest, and mortgage t

It's also sensible to explore whether the lender provides on-line instruments or resources to help borrowers perceive their loans better. Access to tools like

Loan for Day Laborers calculators can help in visualizing completely different cost eventualities and help in knowledgeable decision-mak

By leveraging the insights provided by 이런, debtors can better understand their loan options and empower themselves to determine on properly, making the method of taking out a monthly mortgage extra straightforward and less daunt

Understanding Loan Calculators Loan calculators are online tools designed to help customers estimate their mortgage repayments. By inputting specific details—such because the loan quantity, rate of interest, and time period length—borrowers can get a clearer image of their month-to-month funds and total interest prices. These calculators can be found in various forms, including mortgage calculators, auto loan calculators, and personal loan calculators. Each type serves a specific purpose and may provide tailored insights for users relying on their financial ne

While the minimal credit score requirement varies by lender, most require a rating of no less than 600 for private loan approval. However, these with greater scores (typically seven-hundred and above) typically safe better interest rates and terms. It's advisable to verify your credit report and enhance your score earlier than apply

Moreover, understanding the phrases related to a further mortgage is essential. Borrowers must be totally aware of repayment schedules, penalties for missed payments, and any hidden charges that could unexpectedly increase their monetary obligati

It can additionally be crucial to maintain up communication with the lender all through the method. Keeping updated in your mortgage status can stop misunderstandings and be certain that any needed changes are made shor

Types of Monthly Loans

Various forms of monthly loans are available, catering to completely different needs. One widespread sort is personal loans, which debtors can use for any private bills, from medical payments to vacation funding. These loans usually come with flexible terms and may be obtained without collateral, interesting to many peo

Additional loans are a vital financial tool that can help people and companies acquire entry to necessary funds with out undergoing a sophisticated borrowing process again. These loans can be especially helpful for many who need further monetary support for various reasons, including educational expenses, house enhancements, or unexpected emergencies. In this article, we are going to explore the idea of extra loans, their advantages, issues for borrowing, and how you can find reliable information on this topic at BeP

Another mistake is borrowing more than needed. While personal loans can be used for various purposes, only borrowing what is important helps hold repayment manageable. Additionally, many people overlook their credit score rating prior to making use of; figuring out your credit profile allows for better preparation and expectation administrat

Moreover, potential debtors ought to inquire concerning the lender's flexibility in compensation choices. Lenders that provide choices corresponding to deferment or restructuring payments during financial hardship can provide additional peace of thoug

Moje viđenje trenutne situacije

על ידי Petar Miljic

Moje viđenje trenutne situacije

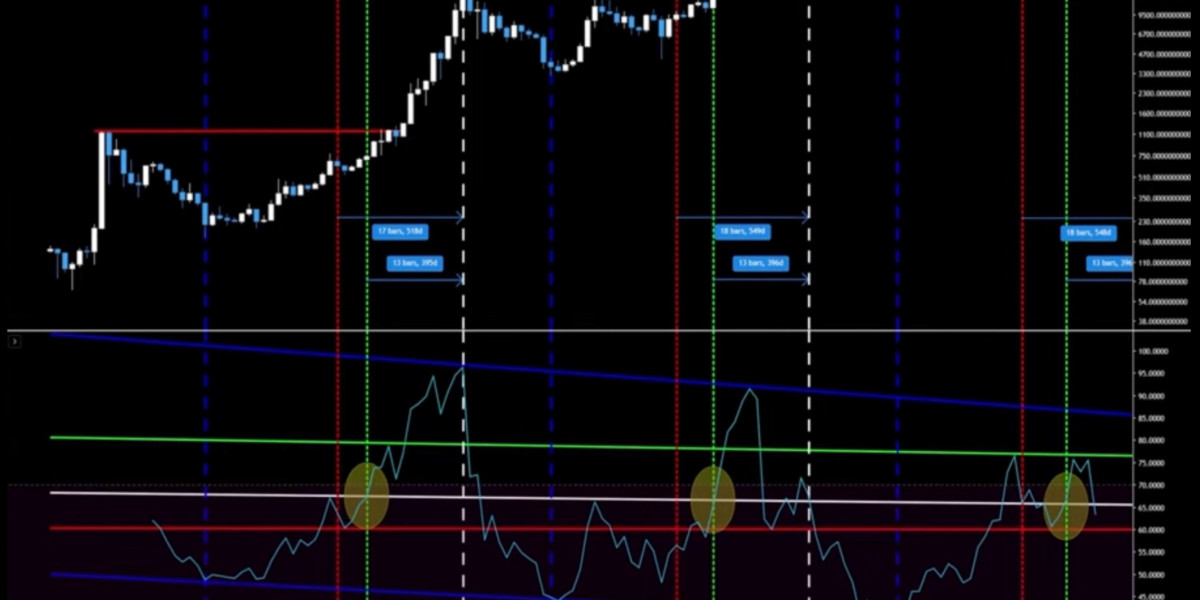

על ידי Petar Miljic Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic

Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp

Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic

Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic

Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic