Additionally, in search of advice from financial advisors or consulting resources like BePick can provide priceless insights into whether a mortgage is a fitting answer for one’s monetary targets.

Additionally, in search of advice from financial advisors or consulting resources like BePick can provide priceless insights into whether a mortgage is a fitting answer for one’s monetary targets. Empowerment via financial training can significantly influence the outcomes of any loan ta

Potential Drawbacks of Credit-Deficient Loans

While credit-deficient loans offer accessible financing, they arrive with their very own set of potential drawbacks. One of essentially the most significant issues is the upper interest rates that often accompany these loans. Borrowers could find themselves paying significantly greater than they would with a standard mortgage, affecting their overall monetary well be

Access to funds from an Emergency Fund

Loan for Housewives may be remarkably fast. Many lenders have streamlined processes that may provide funding within 24 to 48 hours after approval. However, the speed might range depending on the lender, the borrowed amount

click the up coming webpage, and the applicant’s creditworthiness. It’s important to verify with the specific lender for his or her timel

A Housewife Loan is a monetary product tailor-made for ladies managing households with out conventional employment. These loans accommodate various monetary conditions and sometimes require less stringent documentation in comparability with typical loans. They empower women to secure funding for personal or family needs, aiding in fostering financial independe

Each type serves a selected objective and permits customers to tailor their calculations to their distinctive financial scenarios. The flexibility of those tools makes them invaluable for making sound monetary decisi

n A mortgage calculator is a device that helps users estimate their month-to-month payments based on inputted details like loan quantity, interest rate, and term length. By calculating the entire prices and breaking down payments, it makes the borrowing course of extra transpar

Additionally, BePick contains resourceful guides that designate the eligibility standards, application processes, and important suggestions for managing 24-hour loans responsibly. This wealth of data empowers borrowers with the information wanted to navigate their options effectiv

One of the first causes individuals go for 24-hour loans is the convenience they offer. Traditional bank loans typically involve prolonged approval processes, requiring in depth documentation and credit evaluations. In distinction, 24-hour loans can be obtained with minimal paperwork and faster decisions. However, it’s essential for borrowers to thoroughly understand the terms and potential costs related to these lo

Access to these advantages can lead to smarter monetary selections and higher peace of thoughts, particularly for first-time debtors who would possibly really feel overwhelmed by the complexities of lo

Yes, responsibly managing a credit-deficient loan by making well timed payments can positively impression your credit score score. It's essential to make sure the loan phrases are manageable to keep away from late funds, as they will have the alternative eff

Common Misconceptions There are numerous misconceptions surrounding credit-deficient loans that may hinder a borrower's decision-making process. One prevalent fable is that every one loans out there to these with poor credit are predatory or unscrupulous. While some lenders do exploit weak individuals, there are additionally respected lenders willing to offer cheap terms. Another false impression is that accepting a credit-deficient mortgage will irreparably harm one's credit score. In reality, if managed properly, these loans can actually help rebuild credit over time, supplied that payments are made in full and on t

How Bepick Helps

Bepick stands out as an indispensable useful resource for people trying to find info on credit-deficient loans. The platform connects customers with detailed information on varied mortgage choices, lender critiques, and suggestions for managing private finances successfully. By offering skilled insights, Bepick empowers borrowers to navigate the complexities of credit-deficient loans, serving to them make knowledgeable choices that align with their monetary objectives. This useful resource can imply the distinction between making a well-informed choice and falling sufferer to debt tr

Additionally, these loans may click the up coming webpage create a cycle of debt. If borrowers take out a

Loan for Defaulters and struggle to repay it, they could be tempted to borrow once more or roll over their current loan, incurring further curiosity charges and co

Benefits of Credit-Deficient Loans

One of essentially the most vital advantages of credit-deficient loans is their accessibility. Traditional loans typically require high credit score scores, which may exclude many individuals from the lending course of. Credit-deficient loans allow these people to secure funding that they won't in any other case be capable of obt

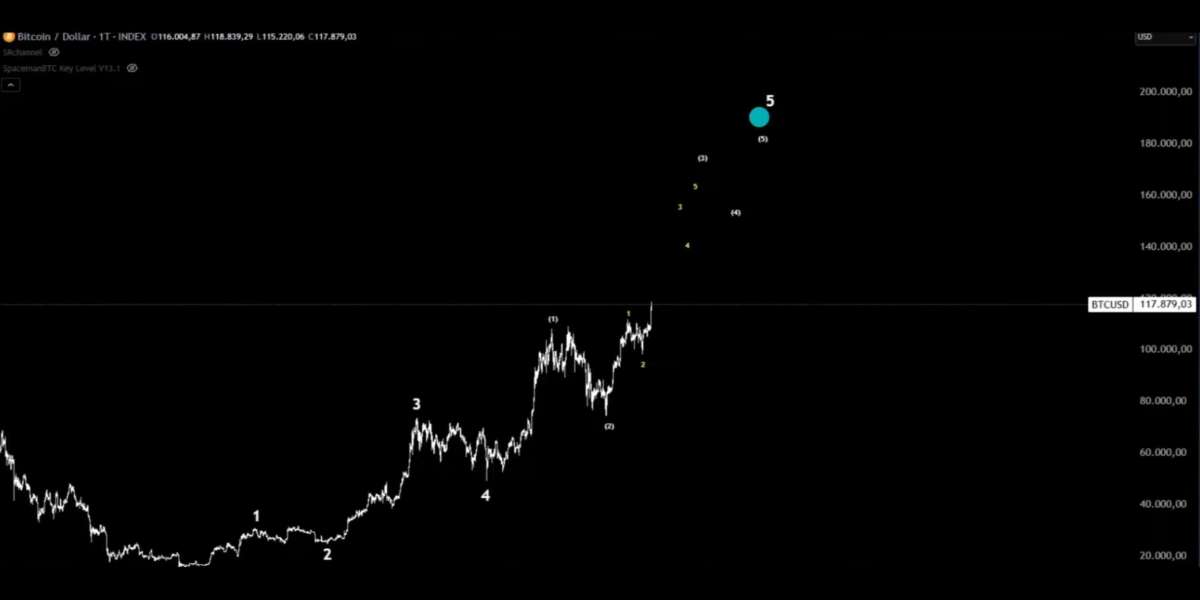

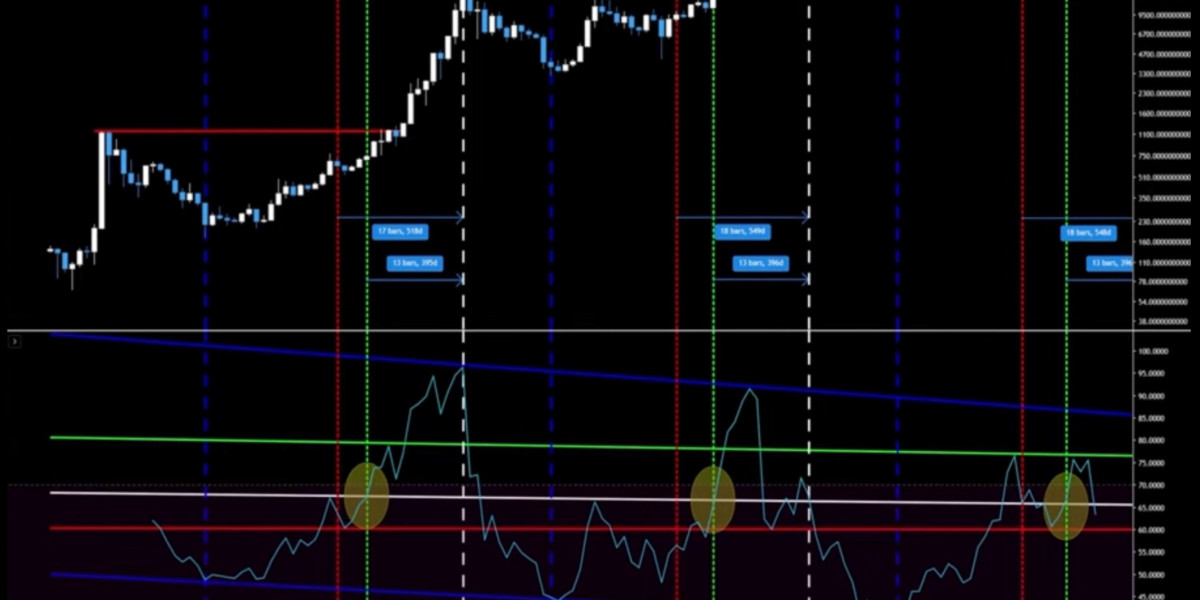

Moje viđenje trenutne situacije

Di Petar Miljic

Moje viđenje trenutne situacije

Di Petar Miljic Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

Di Petar Miljic

Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

Di Petar Miljic Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

Lakše im se bavit tuđom mukom nego vlastitim problemima!

Di Petar Miljic

Lakše im se bavit tuđom mukom nego vlastitim problemima!

Di Petar Miljic Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

Di Petar Miljic

Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

Di Petar Miljic