Many expected this decision to drive Bitcoin’s price higher and solidify its status as a legitimate reserve asset. However, instead of a price surge, the market reacted with a drop, raising questions about the possible macroeconomic consequences of this move. Is the so-called “Trump Pump” over, and is the U.S. facing an economic collapse following this decision?

Bitcoin as a Strategic Reserve – What Does It Mean?

The decision to establish a strategic cryptocurrency reserve in the United States was made as part of a broader economic diversification strategy. Bitcoin, which has so far been primarily considered a speculative asset, is now being added to the national reserves. This move was not entirely unexpected, as the U.S. government has been accumulating large amounts of Bitcoin for years through seizures, particularly from criminal activities.

However, it is important to note that the government did not purchase Bitcoin from the open market, which was a key factor that disappointed many investors. The expectation was that Bitcoin’s inclusion in strategic reserves would involve aggressive state purchases, which would have driven prices higher. Since that did not happen, the market reacted negatively, and Bitcoin’s price dropped by about 5% following the news.

Market Reactions – End of the Euphoria or Just a Correction?

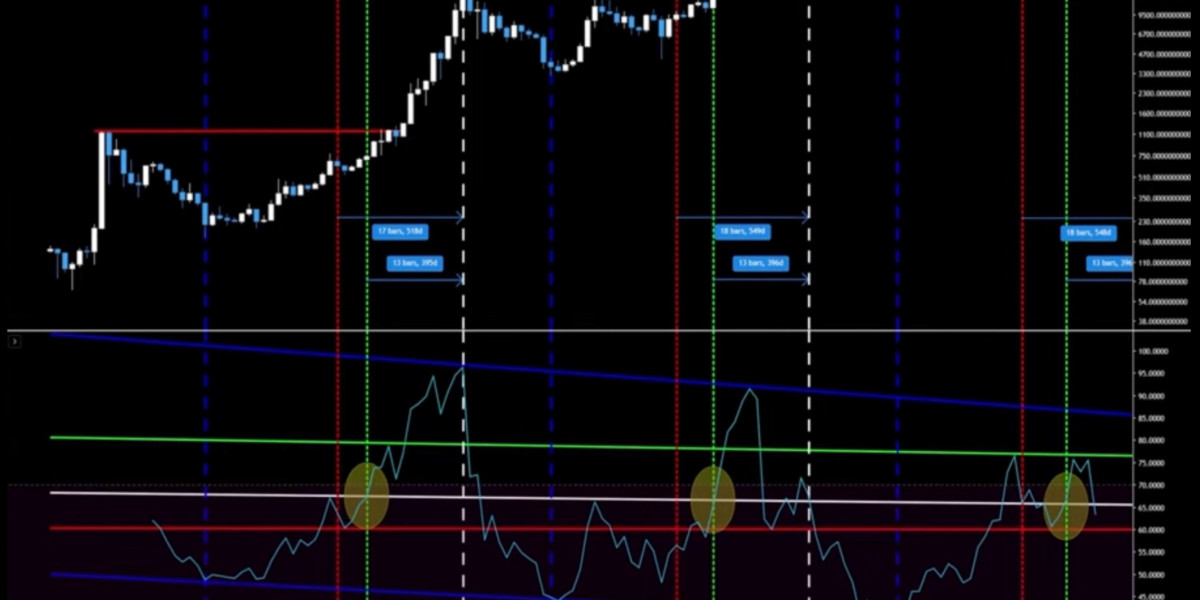

Bitcoin experienced a strong rally earlier this year, reaching new all-time highs due to increased institutional interest and the introduction of spot ETFs. However, with the U.S. administration formally recognizing Bitcoin as part of national reserves—without a concrete strategy for future acquisitions—many are now questioning whether this rally was merely a “Trump Pump” that has now come to an end.

One of the key factors that will determine the market’s direction is the policy of the Federal Reserve (FED). If U.S. inflation continues to rise and the FED is forced to maintain high interest rates, it could create challenges for Bitcoin’s further growth.

On the other hand, if economic instability worsens and investors start seeking safe-haven assets, Bitcoin could assume a role similar to gold and experience a new surge.

Is the U.S. Heading for an Economic Collapse?

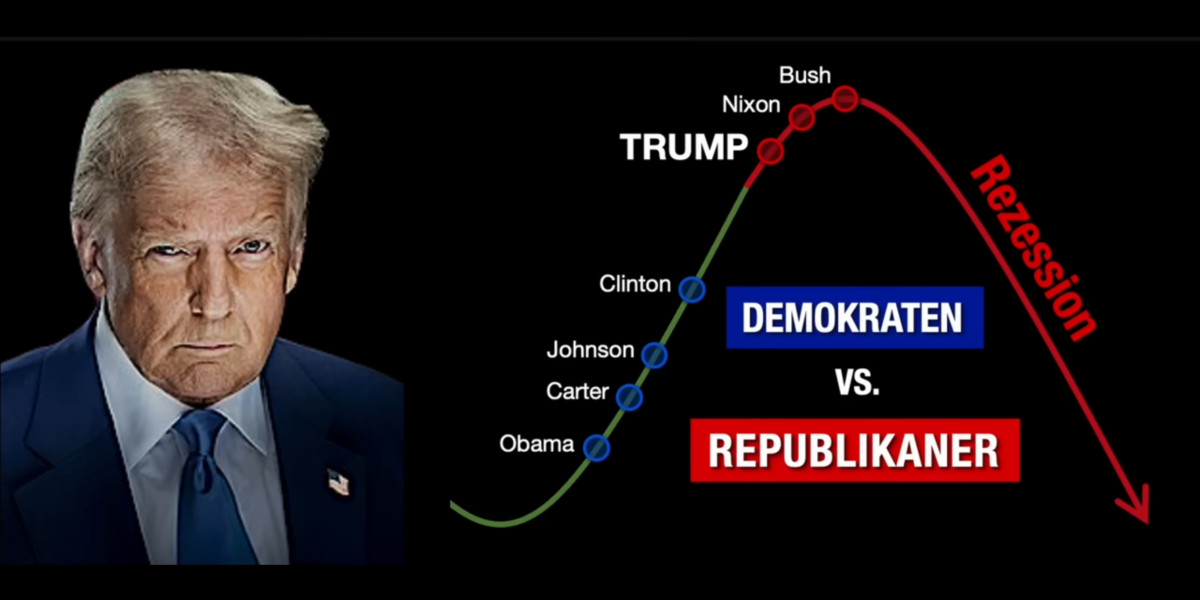

The U.S. economy has been balancing between growth and potential recession for years. High interest rates, rising national debt, and increasing geopolitical tensions are all weighing heavily on the system. In this context, the question arises: will the introduction of Bitcoin into strategic reserves further destabilize or strengthen the U.S. economy?

There are two possible scenarios:

• Bitcoin as an Inflation Hedge – If U.S. inflation rises and the dollar continues to lose value, Bitcoin could become a key asset for preserving wealth, much like gold. In this case, the U.S. could benefit from early adoption of this asset class.

• Bitcoin as a Factor of Instability – Given Bitcoin’s volatility, there is a risk that the national balance sheet could become even more unpredictable. If Bitcoin experiences a sharp decline, the value of reserves could drop significantly, increasing pressure on public finances.

Conclusion: What Can We Expect?

While the establishment of a Bitcoin strategic reserve is a significant step toward the institutionalization of cryptocurrencies, the market has shown that it is not impressed with the decision. There is no clear indication that the U.S. government will actively buy Bitcoin in the open market, meaning the current price decline could be due to investor disappointment.

As for the future of the U.S. economy, many factors will play a role. If the global economic crisis deepens, Bitcoin could gain significance as an alternative asset. However, if inflation and debt continue to rise without an adequate response from the Federal Reserve, the U.S. could face serious economic challenges.

One thing is certain—the inclusion of Bitcoin in national reserves marks the beginning of a new era in finance, and how things unfold will depend on the market, regulatory decisions, and global economic factors.

BALKAN

Trump pumpa je gotova?

Da li SAD dolazi krah posle uvođenja Bitcoina u američke strateške rezerve?

Najnoviji potez američke administracije da uključi Bitcoin u državne strateške rezerve izazvao je lavinu reakcija na tržištu. Mnogi su očekivali da će ova odluka donijeti dodatni rast cijeni Bitcoina i potvrditi njegov status kao legitimne rezervne imovine. Međutim, umjesto toga, tržište je reagovalo padom, a pojavila su se i pitanja o mogućim makroekonomskim posljedicama ovog poteza. Da li je „Trump pumpa“ završena i da li se SAD suočava sa ekonomskim kolapsom nakon ovog poteza?

Bitcoin kao strateška rezerva – šta to znači?

Odluka o uspostavljanju strateške rezerve kriptovaluta u Sjedinjenim Američkim Državama donijeta je kao dio šire strategije ekonomske diverzifikacije. Bitcoin, koji je do sada uglavnom smatran spekulativnom imovinom, sada ulazi u portfelj državnih rezervi. Ova odluka nije neočekivana, jer je američka vlada već godinama kroz zapljene prikupljala velike količine Bitcoina, posebno iz kriminalnih aktivnosti.

Međutim, važno je naglasiti da vlada nije kupovala Bitcoin na otvorenom tržištu, što je bio ključni faktor koji je razočarao mnoge investitore. Očekivalo se da će ulazak Bitcoina u strateške rezerve značiti i agresivne kupovine od strane države, što bi dodatno podiglo cijenu. No, kako se to nije desilo, tržište je reagovalo negativno, a cijena Bitcoina pala je za oko 5% nakon ove vijesti.

Tržišne reakcije – kraj euforije ili samo korekcija?

Bitcoin je početkom godine doživio snažan rast, pri čemu je dostizao nove rekorde zahvaljujući rastu interesovanja institucionalnih investitora i uvođenju spot ETF-ova. Međutim, odlukom američke administracije da formalizuje Bitcoin u državnim rezervama, bez konkretne strategije daljih kupovina, mnogi su se zapitali da li je ovaj rast bio samo „Trump pumpa“ koja je sada došla do svog kraja.

Jedan od ključnih faktora koji će odrediti dalji smjer tržišta jeste politika Federalnih rezervi (FED). Ako se inflacija u SAD-u nastavi povećavati, a FED bude prinuđen da održava visoke kamatne stope, to bi moglo otežati dalji rast cijene Bitcoina.

S druge strane, ako ekonomska nestabilnost postane ozbiljnija i investitori počnu tražiti sigurno utočište, Bitcoin bi mogao imati ulogu sličnu zlatu i ostvariti novi talas rasta.

Da li SAD dolazi ekonomski krah?

Američka ekonomija već godinama balansira između rasta i potencijalne recesije. Visoke kamatne stope, rastući državni dug i geopolitičke tenzije sve više opterećuju sistem. U tom kontekstu, pitanje koje se postavlja jeste: da li će uvođenje Bitcoina u strateške rezerve dodatno destabilizovati ili ojačati američku ekonomiju?

Postoje dva scenarija:

1. Bitcoin kao zaštita od inflacije – Ako se inflacija u SAD-u poveća i dolar nastavi gubiti vrijednost, Bitcoin bi mogao postati ključna imovina za očuvanje vrijednosti, slično kao zlato. U tom slučaju, SAD bi mogao imati koristi od ranog ulaska u ovu klasu imovine.

2. Bitcoin kao faktor nestabilnosti – S obzirom na volatilnost Bitcoina, postoji rizik da državni balans postane još nepredvidljiviji. Ako Bitcoin doživi nagli pad, vrijednost rezervi bi mogla značajno oslabiti, što bi povećalo pritisak na javne finansije.

Zaključak: Šta možemo očekivati?

Iako je uspostavljanje strateške rezerve Bitcoina značajan korak u pravcu institucionalizacije kriptovaluta, tržište je pokazalo da nije impresionirano ovom odlukom. Ne postoji jasan signal da će američka vlada aktivno kupovati Bitcoin na tržištu, što znači da trenutni pad može biti rezultat razočaranja investitora.

Što se tiče budućnosti američke ekonomije, ona zavisi od mnogo faktora. Ako se globalna ekonomska kriza produbi, Bitcoin bi mogao dobiti na značaju kao alternativna imovina. Međutim, ako se inflacija i dug nastave povećavati bez adekvatnog odgovora Federalnih rezervi, SAD bi se mogao suočiti s ozbiljnim ekonomskim izazovima.

Jedno je sigurno – ulazak Bitcoina u državne rezerve označava početak nove ere u finansijama, a kako će se stvari dalje razvijati, zavisiće od tržišta, regulatornih odluka i globalnih ekonomskih faktora.