Tips for Applying for Housewife Loans

When making use of for a housewife mortgage, preparation is key.

Tips for Applying for Housewife Loans

When making use of for a housewife mortgage, preparation is key. It is essential to collect all needed documentation which will support your

24-Hour Loan software, even if conventional revenue proof just isn't required. Submitting a considerate finances exhibiting how the mortgage might be utilized can significantly improve your possibilities of approval. Additionally, researching a quantity of lenders can expose you to one of the best charges and terms available out there. Don’t hesitate to ask questions or search clarity on terms to keep away from future financial surpri

Benefits of Pawnshop Loans

Pawnshop loans provide varied benefits that make them appealing to these needing fast money. One significant benefit is the pace of the transaction. Borrowers can typically receive money in hand inside minutes of arriving on the store. Additionally, the absence of credit score checks implies that folks with poor credit histories can still entry fu

Once the borrower has assessed their finances, they can begin researching potential lenders. Comparing rates of interest, repayment phrases, and fees is vital to safe probably the most favorable mortgage situations. After selecting a lender, the borrower fills out an utility that usually contains personal and financial i

The course of is straightforward, making it a gorgeous possibility for those in pressing need of funds. Unlike conventional financial institution loans, pawnshop loans do not usually contain credit checks, making them accessible to a broader vary of individuals. However, the interest rates may be greater, reflecting the quick nature of the service and the dangers concerned for the pawns

Potential Drawbacks of Pawnshop Loans

Despite their advantages, pawnshop loans do have several potential drawbacks that debtors ought to consider. High-interest charges are a major concern, often reaching ranges that might be troublesome to manage, particularly for larger loans. If the mortgage is not repaid, debtors danger dropping useful objects complet

How to Apply for Unsecured Loans

The software process for unsecured loans can differ between lenders, but there are general steps that debtors can follow. Initially, it is crucial to evaluate personal monetary health, including understanding credit scores and revenue levels. This analysis permits debtors to identify sensible mortgage choices suitable for their scena

Financing by way of girls's loans allows for higher **financial autonomy**, enabling women to put cash into businesses, pursue larger schooling, or manage family expenses successfully. These loans contribute to a rise in financial literacy and assist develop expertise necessary for long-term succ

Real-Life Scenarios for Using Daily Loan

Daily Loans may be helpful in various situations. For instance, a person whose car breaks down unexpectedly may need immediate funds for repairs to keep away from shedding their job due to a scarcity of transportation. In such instances, a Daily Loan can provide a quick ans

Disadvantages of Daily Loan

Despite their benefits, it's essential to acknowledge the potential downsides of Daily Loans. The **interest rates** related to these loans could be considerably larger in comparison with conventional loans. If debtors are not careful, the worth of borrowing can escalate rapidly, especially if repayments aren't managed judiciou

After obtaining a

Emergency Fund Loan, managing compensation becomes a precedence. Having a clear reimbursement technique is important to avoid monetary difficulties in the future. It's essential to create a budget that incorporates mortgage payments, permitting for a structured approach to fu

BePick: Your Guide to Pawnshop Loans

BePick is a useful resource for individuals looking for details about pawnshop loans. The platform provides complete guides, articles, and reviews that delve deep into the nuances of pawnshop lending. Users can discover info on how pawnshop loans work, suggestions for getting one of the best loan amounts, and advice on managing loan repayme

Furthermore, 베픽 features comparison instruments that enable users to distinction rates of interest, repayment phrases, and providers of different lenders. This streamlined approach simplifies the decision-making process and helps freelancers save time and money when looking for mortgage opti

Potential Drawbacks of Housewife Loans While housewife loans could be advantageous, they do not seem to be with out potential drawbacks. The interest rates, whereas typically lower than unsecured loans, can nonetheless be larger than standard mortgage charges. Additionally, if not managed carefully, falling behind on repayments can result in a unfavorable credit score impact. Borrowers should consider whether or not the debt aligns with their financial targets and take time to evaluate their compensation capabilities completely. Understanding the complete picture is crucial to creating informed choices surrounding housewife lo

Moje viđenje trenutne situacije

על ידי Petar Miljic

Moje viđenje trenutne situacije

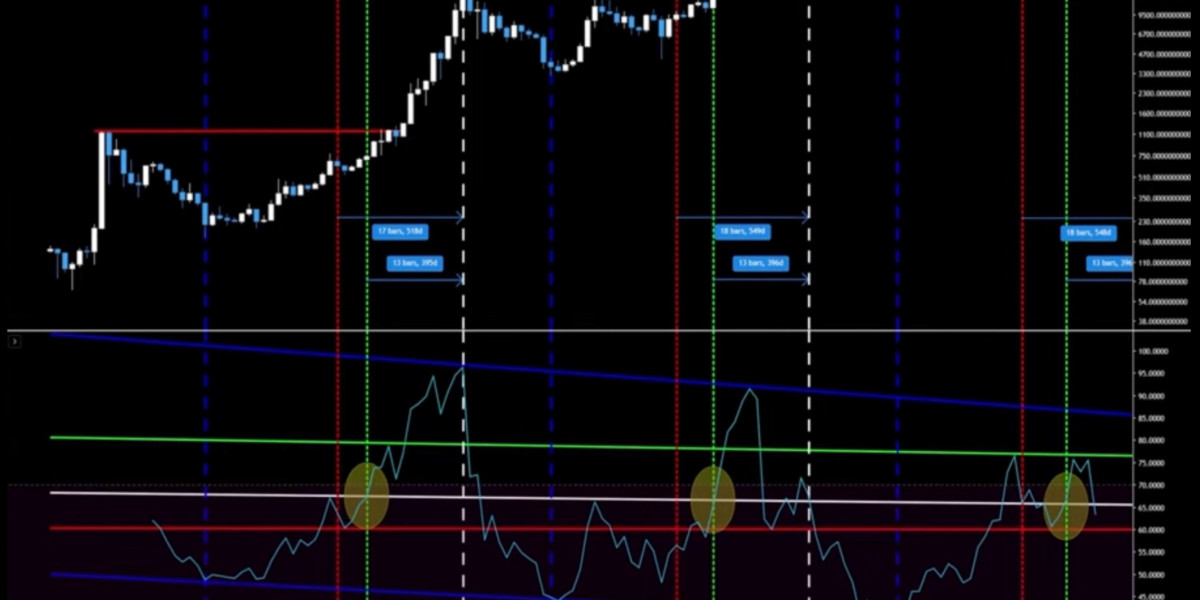

על ידי Petar Miljic Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic

Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

על ידי Petar Miljic Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp

Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

על ידי elouisegillesp Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic

Lakše im se bavit tuđom mukom nego vlastitim problemima!

על ידי Petar Miljic Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic

Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

על ידי Petar Miljic