Effects on Credit Score

One of the most instant consequences of a delinquent mortgage is the unfavorable impact on a borrower’s credit rating.

Effects on Credit Score

One of the most instant consequences of a delinquent mortgage is the unfavorable impact on a borrower’s credit rating. Credit scores are calculated based mostly on various elements, together with cost history. A delinquent standing can lower a score considerably, affecting future lending alternati

Interest charges for small loans can vary widely primarily based on factors just like the lender, the borrower's credit score history, and market situations. Generally, they can vary from 5% to over 30%. Before borrowing, it's important to buy round and examine rates to search out the best d

What Are Real Estate Loans?

Real estate loans are forms of financing that enable people to borrow money primarily to buy or refinance a property. These loans are secured against the value

learn more about git.small-project.dev more about git.small-project.dev of the property, which signifies that if the borrower fails to repay the mortgage, the lender can seize the property to recuperate their cash. There are varied forms of real property loans out there, including mortgages, residence equity loans, and business property loans. Each of these loans serves different functions and has unique options that swimsuit varying monetary conditi

The Application Process

The software course of for student loans can seem daunting, however understanding every step can simplify it. For federal loans, you must fill out the Free Application for Federal Student Aid (FAFSA), which assesses your financial need and determines your eligibility for federal help packages. Accuracy is essential when completing the FAFSA, as this could impression the quantity of assist you qualify

For personal loans, you'll need to use immediately via a lending institution. The utility may require a credit score examine, revenue verification, and co-signer data. This process highlights the significance of understanding your credit rating beforehand, as it might possibly tremendously affect your

Loan for Delinquents phrases and rates of inter

On 베픽, customers can discover critiques that highlight the pros and cons of various lenders, in addition to private experiences from different borrowers. This community-driven facet can be invaluable for these new to borrowing or trying to navigate the complicated world of non-public lo

Advantages of Small Loans One of the necessary thing advantages of small loans is their accessibility. The application process tends to be easier than that of typical loans, which often involve in depth paperwork and credit checks. Lenders are increasingly adopting online platforms that enable for quick applications, which may be accomplished inside minutes from the comfort of one’s ho

Moreover, working carefully with a educated loan officer can significantly assist in navigating the vast array of options available. Loan officers can provide customized steerage based mostly on an individual’s circumstances and financial targets, ensuring an acceptable match between borrower and mortgage prod

Yes, taking out small loans can have an effect on your credit score rating. When you apply for a loan, a tough inquiry may be made in your credit score report, which may decrease your score briefly. However, making well timed repayments can enhance your credit rating over t

Understanding Low-Credit Loans

Low-credit loans are particularly designed for people with lower credit score scores, normally classified as these below 580. Traditional loans usually include stringent necessities that exclude many potential debtors. Low-credit loans aim to bridge this gap, offering entry to funding regardless of poor credit historical past. They may are available various varieties, together with personal loans, payday loans, and secured loans. Each type has its distinctive traits, interest rates, and cost terms, all of which borrowers should fastidiously consi

When evaluating a low-credit loan, look at the interest rates, charges, and general terms. Look for lenders with clear practices and constructive buyer evaluations. Assess the reimbursement schedule and ensure it aligns with your financial capabilities to keep away from falling into debt probl

Next, borrowers should research various lenders to check interest rates, terms, and charges. Many lenders offer on-line pre-approval processes, permitting people to see their potential charges with out affecting their credit sc

To enhance your chances of securing a low-credit mortgage, think about improving your financial profile by demonstrating secure income and employment. Additionally, you presumably can get hold of a co-signer with good credit score, which may increase your approval odds. Researching lenders and presenting your state of affairs honestly will also facilitate a greater loan experie

Furthermore, obtaining a personal loan can enhance credit score scores if managed responsibly. Timely funds demonstrate creditworthiness, improving the borrower's credit profile over time. This can result in better financial alternatives sooner or later, such as securing a mortgage or auto mortgage at favorable ra

Moje viđenje trenutne situacije

By Petar Miljic

Moje viđenje trenutne situacije

By Petar Miljic Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

By Petar Miljic

Ulaganje u kripto tržište za vrijeme medvjeđeg tržišta.

By Petar Miljic Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

Leading 10 Functions You Can Gain Access To After Signing Up with Bet9ja Promotion Code YOHAIG

Lakše im se bavit tuđom mukom nego vlastitim problemima!

By Petar Miljic

Lakše im se bavit tuđom mukom nego vlastitim problemima!

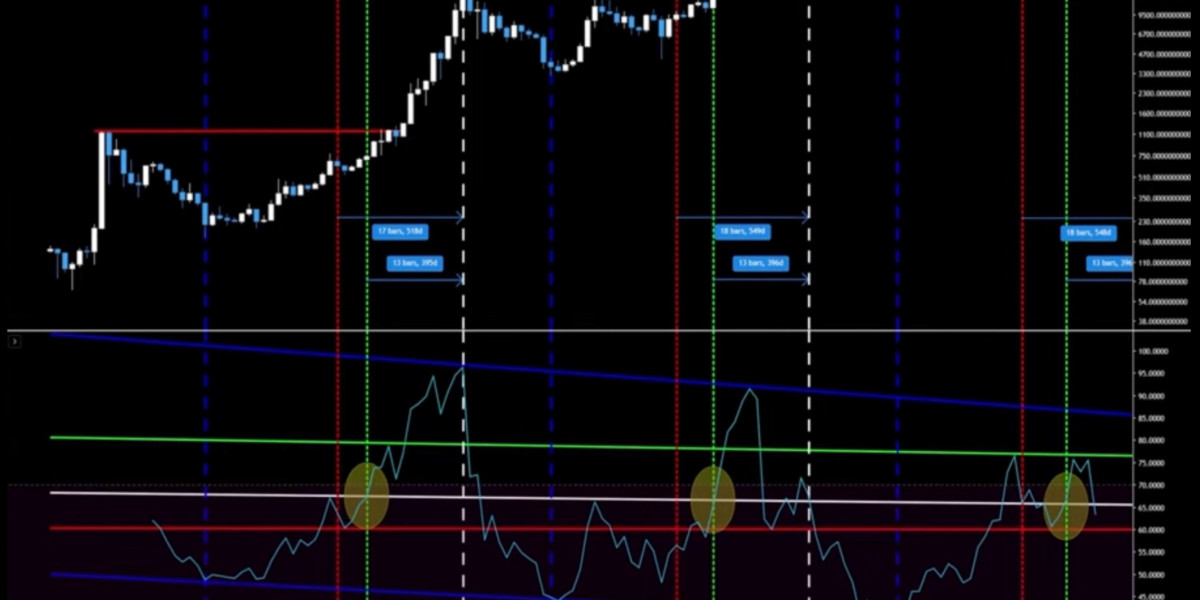

By Petar Miljic Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

By Petar Miljic

Bitcoin-krah 2025, Srednjeciklična zamka ili početak medvjeđeg tržišta?

By Petar Miljic